what is the tax year 2022 - Who should file a tax return how to get ready for taxes filing and payment due dates reporting your income and claiming deductions and how to make a payment or check the status of your

[desc_11]

Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax

what is the tax year 2022

what is the tax year 2022

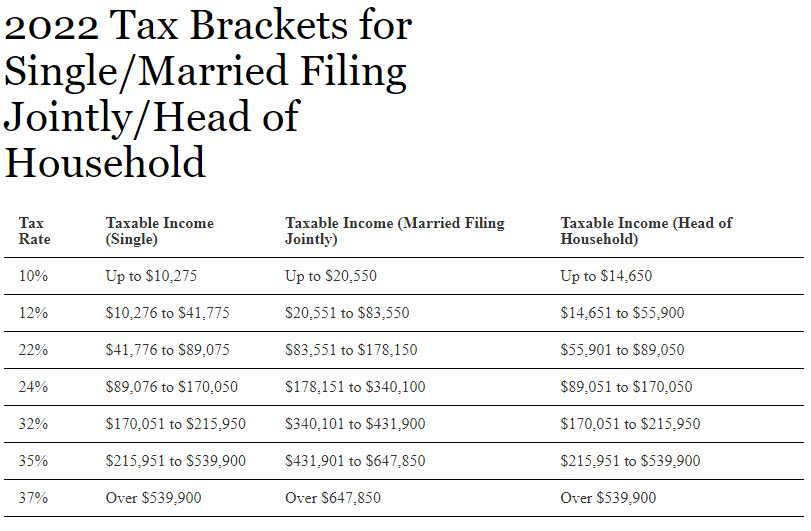

The bulk of tax relief will go to those with incomes in the two lowest tax brackets (i.e., those with taxable income under $114,750 in 2025), including nearly half to those in the.

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax rates apply

Taxes Canada Ca

Income tax Personal business corporation trust international and non resident income tax

[desc-12]

What Date Was The End Of The Tax Year 2022 YouTube

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

2022 Tax Changes Method CPA

Tax Year 2022 23 Free Tax Filing Preparation VITA U S Individual Tax

Personal Income Tax Canada Ca

Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

Financial Staleness Calendar 2023 Printable Word Searches

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

[desc_10]

Government Of Canada Delivering Middle Class Tax Cut

When using certified tax software the Auto fill my return service automatically fills in parts of your income tax and benefit return with information that the CRA has available at

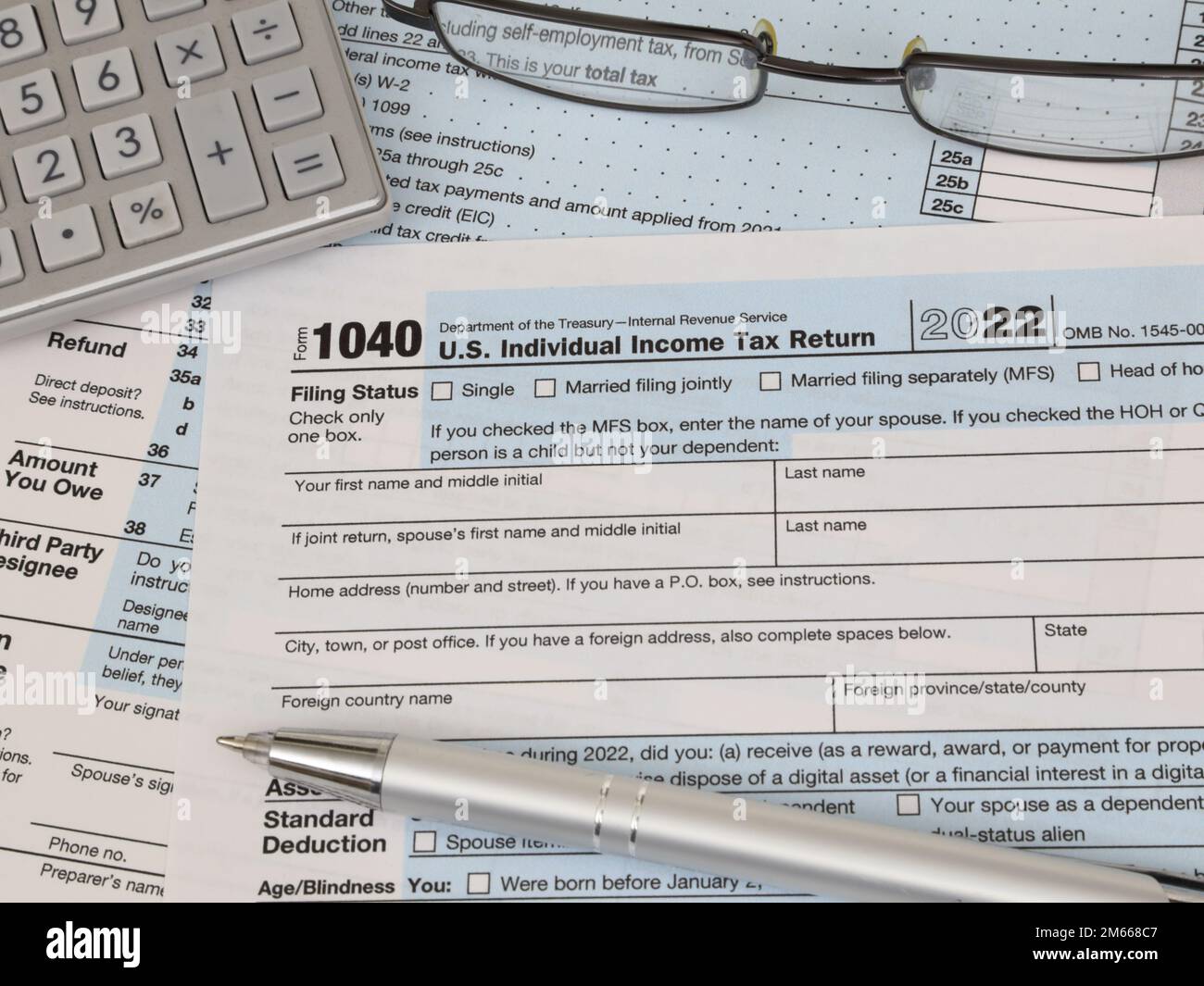

An IRS 1040 Tax Year 2022 Form Is Shown Along With An Ink Pen

Effortless Tax Filing With TaxAct 2023 Tax Year 2022 Review YouTube

what is the tax year 2022

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

https://www.canada.ca › en › revenue-agency › services › tax › individual…

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax rates apply

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax

What Is My Tax Bracket For The 2022 Tax Year United Financial Services

Understanding Tax Year 2022 Vs 2023 What You Need To Know For The

Autumn Statement 2022 HMRC Tax Rates And Allowances For 2023 24

UWGC Free Tax Prep Volunteer Information Session Tax Year 2022

IRS Tax Brackets For 2023 Taxed Right

Tax Changes For 2022 What You Need To Know DOAAR

2024 Tax Rates Lucke And Associates CPAs L C